CareCredit, the health, wellness and personal care credit card dedicated to helping people get the care they want and need, today announced enhanced features to its mobile app.

This upgrade reinforces CareCredit’s commitment to provide its more than 10.5MM cardholders with the latest technology for added on-the go-convenience to manage their accounts.

The mobile app is one of several helpful cardholder tools including Pay My Provider and CareCredit Direct. Available in both Google Play and the Apple App Store, the mobile app helps cardholders manage their account. Through the app, cardholders can pay their bill, locate enrolled providers and businesses that accept the CareCredit credit card, set custom payment alert notifications and more all from the convenience of a mobile device.

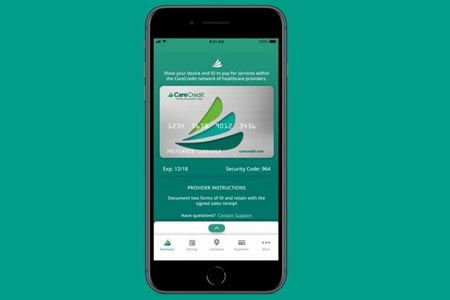

Developed with extensive usability testing, the mobile app leverages the same log-in credentials as CareCredit’s online and mobile sites, but incorporates enhanced security controls such as device authentication and Face ID. App users can enable Face ID in their settings and then log in via facial recognition instead of fingerprint or using their username/password for added peace of mind. The app also incorporates pre-login access to the popular CareCredit digital card, allowing cardholders to access a digital version of their CareCredit healthcare credit card on their mobile device, eliminating the need for cardholders to bring the card with them at the time of care.

“As today’s consumers take on more financial responsibility and become more actively involved in their care, they are increasingly expecting personalized and convenient experiences through all channels,” said Dave Fasoli, executive vice president & CEO of CareCredit. “We know that financing is an important factor for patients considering healthcare decisions, and these enhancements to our mobile app provide CareCredit cardholders a useful and accessible tool to help make those important financial decisions faster and easier.”

According to a recent InstaMed, Trends in Healthcare Payments study, consumers expect a streamlined healthcare payment experience, with 71 percent wanting to pay all their healthcare expenses in one place.1 The study also found that patients say they will leave a practice that leaves them frustrated/dissatisfied. In fact, 65 percent of consumers surveyed would consider switching providers for a better healthcare payments experience. Consumers are utilizing technology now more than ever and the new mobile application upgrades can help consumers conveniently manage their accounts whenever they want, wherever they are.

About CareCredit®

For over 30 years CareCredit, a Synchrony solution, has helped millions of people pay for needed and desired care and health expenses. CareCredit is a health, beauty, wellness and personal care credit card accepted through a national network of more than 200,000 healthcare provider locations and select health-focused retailers. For more information on CareCredit, call 800-300-3046 or visit www.carecredit.com. For more information about Synchrony visit www.synchrony.com

About Synchrony

Synchrony (NYSE: SYF) is a premier consumer financial services company delivering customized financing programs across key industries including retail, health, auto, travel and home, along with award-winning consumer banking products. With more than $130 billion in sales financed and 74.5 million active accounts, Synchrony brings deep industry expertise, actionable data insights, innovative solutions and differentiated digital experiences to improve the success of every business we serve and the quality of each life we touch. More information can be found at www.synchrony.com

1 InstaMed, Trends in Healthcare Payments Eighth Annual Report: 2017, May 2018

Contact"

CareCredit

David Salzman, 203-585-6208